What It Took to Make The Leap For That $3,075,000 Property

I have to admit I was scared.

I took a deep breath as I signed the check request for $75,000. If we didn’t get the $3,075,000 we needed to purchase this 77-unit building plus the $500,000 to renovate it, we would lose the $75,000 earnest money.

We had never bought an apartment building before. Up to this date, the largest thing we’d ever managed was a duplex. I looked at my husband. He seemed a little pale. I’m sure I did too. I took his hand in mine. “Let’s do this,” I said.

A week later we put in an offer for another building – 51 units, selling for $1,800,000.

Three months later, we sat toasting at an elegant restaurant in Albuquerque on the day we closed escrow and became the owners. That week we bought two buildings in Albuquerque – 128 units total. We raised over $2.2 million dollars from private investors and got bank loans totaling $3,900,000. Even though we’d never done anything like this before, we were able to acquire two properties at the same time.

How w...

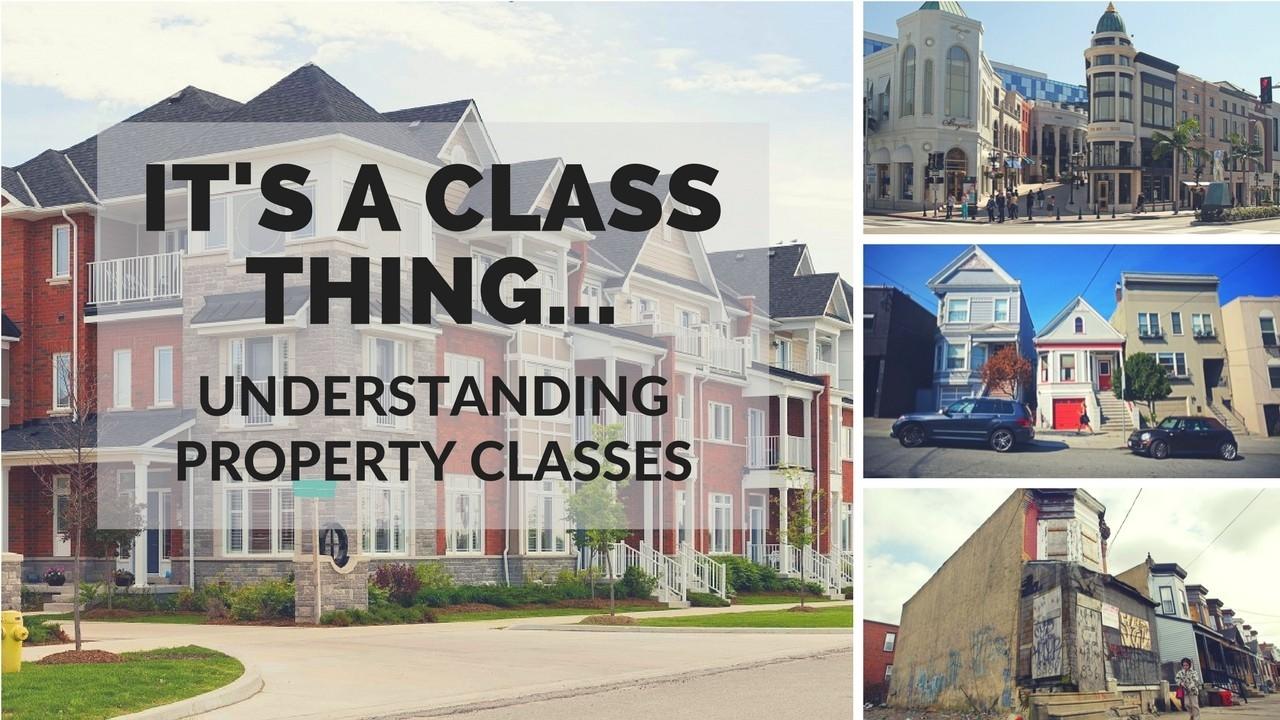

It's a Class Thing -- Understanding Property Classes

We get on the phone every week with building property managers. We are never quite sure what we are going to hear.

There was the call about a drive-by shooting that thankfully didn’t hit anybody, the call about the fire in one of our townhouses that was a result of a love spat gone very, very bad, the call about the 10 units (out of 51) that we were going to have to evict in one month because they hadn’t been paying rent, the call about the ex-con who threatened our property manager with a gun because he wasn’t happy about said eviction, the call about our elderly tenant who can’t pay rent because he thought a Nigerian Prince was really going to send him $10,000,000 and he sent a bank check equaling more than 2 months of his rent, and so much more.

This is what it’s like dealing with a Class C building. [If you don’t know what that is yet, keep reading].

Lately though the calls have been different. There was the call when in one week several tenants from each building stopped ...